As the demand for accountants is outpacing the supply, businesses are increasingly turning to outsourced accounting services. Since the number of accounting graduates is declining, the internal teams are facing burnout. This is where outsourcing steps in, to offer solutions for improved efficiency, reduce errors, and support growth. In 2025, outsourcing bookkeeping services is not just to space out the workload, it is a strategic investment!

What Accounting Functions Can be Outsourced?

Outsourcing accounting functions has become essential for businesses seeking to improve efficiency and agility. According to Deloitte’s 2018 Global Outsourcing Survey, companies are increasingly focusing on outsourcing to transform their operations, rather than just cutting costs. Most accounting functions can be outsourced, including bookkeeping, monthly accounting, cash flow forecasting, and outsourced online CFO services. By choosing services that align with specific financial needs, businesses can benefit from high-level expertise without overpaying for unnecessary services. This flexibility allows companies to remain focused on growth while managing finances efficiently.

Why are Companies Outsourcing?

Reduces Errors

Outsourcing accounting and online CFO services helps minimize errors by providing access to specialized professionals. These experts stay current with industry standards and leverage advanced technology to eliminate manual processes like data entry. With experience across various industries, outsourced accountants know common pitfalls and can proactively address them, ensuring accuracy from day one. This means timely, precise financial records without the risk of costly mistakes, allowing you to focus on business growth while avoiding audit issues and ensuring smooth, error-free operations. Outsourced accounting services ensure error-free, high-quality outcomes every time.

Streamline Processes

Online CFO services can greatly streamline business processes. Outsourced accounting services firms, like Spacebucks, specialize in process improvement for small businesses. With experience across a wide range of industries, outsourced accountants bring best practices, proven workflows, and fresh perspectives to evaluate and optimize existing processes. By reviewing current accounting practices, these firms can identify inefficiencies, automate routine tasks, and design safeguards to prevent errors and fraud.

Cost-effective

Outsourced accounting services can significantly reduce operational costs for businesses. Small businesses can access CFO-level expertise with online CFO services at a fraction of the cost of hiring in-house staff, saving money on salaries, recruitment, training, and employee benefits. Outsourcing can cut costs by up to 60%, freeing up resources for core business activities. In India, businesses can further save on overheads, software, training, and office space costs, benefiting from lower labour costs due to the country’s lower cost of living.

Access to New Tech and Tools

Outsourced accounting services link bookkeeping allows businesses to leverage advanced technologies that would otherwise be costly to implement. External firms have access to the latest software and tools, ensuring accuracy, efficiency, and automation in bookkeeping processes. This eliminates manual errors and reduces administrative burdens. Online CFO services firms in India, equipped with cutting-edge software and IT infrastructure, offer businesses access to top-tier technology, ensuring streamlined processes, better integration, and innovative solutions to meet future business needs.

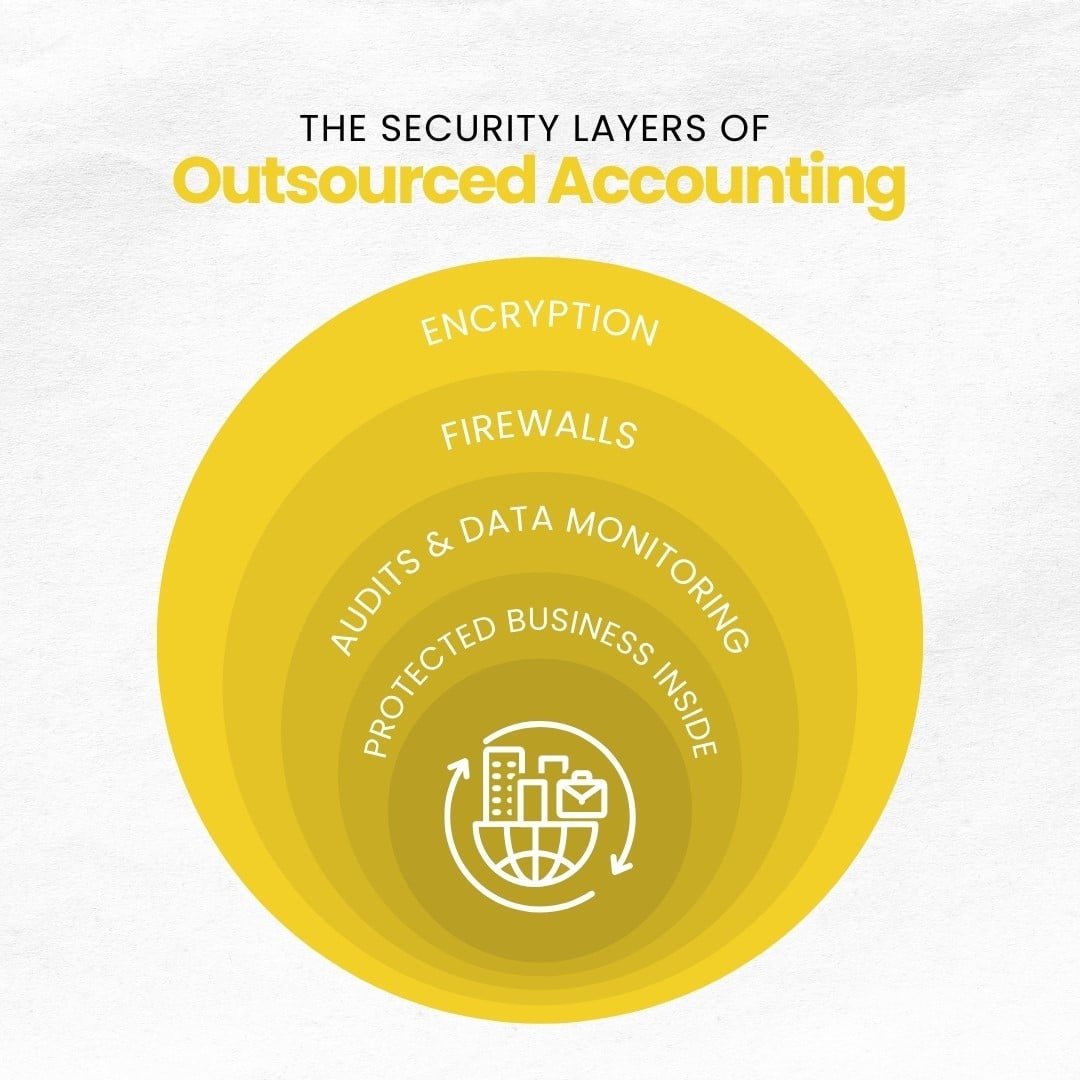

Robust Data Security

Firms with outsourced accounting services provide enhanced security for your financial data. With advanced technologies and stringent cybersecurity measures, outsourcing firms ensure the protection of sensitive information. Regular security audits and updates, along with encryption and controlled access protocols, reduce the risk of data breaches and cyberattacks. By outsourcing online CFO services, you can secure your financial records in a protected environment, allowing you to focus on business growth without worrying about data vulnerabilities.

Improves Performance

Companies are outsourcing online CFO services and accounting services to improve performance and efficiency. By hiring specialized professionals, businesses gain expertise in areas like tax, mergers, and reporting. Outsourced accounting services firms ensure timely, accurate record-keeping, leading to meaningful financial insights. Utilizing advanced tools and automation, offshore bookkeepers streamline processes, allowing in-house teams to focus on other priorities. This enhanced efficiency helps businesses stay ahead of competitors while maintaining financial clarity and control.

Outsourced accounting services is a strategic move that every business needs in 2025 to enhance efficiency and reduce errors at lower operational costs. Expert professionals with cutting-edge technology and robust security can provide businesses ease and empower them to focus on growth and innovation.

For exceptional results and tailored accounting services, Spacebuck in Mumbai is a go-to partner. They offer top-quality outsourced solutions ensuring seamless financial management. Experience reliable, cost-effective, and accurate accounting that supports your success every step of the way.